WIVEL’s Connect2Core (C2C) enables

a real-time connection with financial

institution core systems and applications in

order to post payment data to borrowers’

accounts immediately after transactions

submission. C2C also provides account

lookup and the ability to post payment

information to your banking core (i.e.

Symitar).

Experience Real-Time Payment Posting Connect2Core

C2C enhances operational efficiency and offers unique employee and borrower benefits:

- Batch file processing for posting

- Borrowers will have their

loans credited immediately - Leverages the same process to settle

funds as current posting option - Payment inquiry calls are reduced

- Multi-channel real-time posting

- Access up-to-date data on borrowers’

account, including posting status

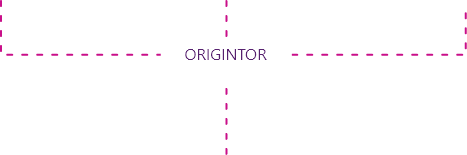

Mark makes payment via web

Sylvia makes payment via IVR

Representative collects John’s payment via Phone

SWIVEL’s payment system will generate TEL transactions for payments made via representative or IVR, and WEB transactions for payments submitted via web.

Transactions securely posted utilizing core integration

SWIVEL will securely transmit transaction data in real time via core integration method, including GL offset.

One CCD credit transaction will be generated to the designated settlement account and will include the sum of all convenience fees and payments from that day.

Our payment system will generate TEL transactions for payments made via representative or IVR, and WEB transactions for payments submitted via web..

Processes in ACH Operator

(Federal Reserve)

Your ACH operators will see one CCD transaction with the payments and fees combined come in through the normal

ACH Channel

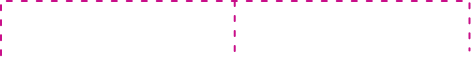

Settlement activity to the Financial Institution based on core requirements.

ACH—Next business day

Card Transactions — Two business days

Cash Transactions — Next business day

The Settlement/Clearing Account Transaction codes utilized for credits:

42 — GL Deposit

22 — Checking Deposit

32 — Savings Deposit

Mark’s

Auto Loan

Sylvia’s

Auto Loan

John’s

Boat Loan

External loan payments can be accommodated based on core requirements.

BENEFITS

- Elimination of time-consuming Batch File Processing

- Borrowers will have their loans credited immediately

- Leverages the same settlement options and processes you currently have.

- Reduced inquiry calls related to payments

- Multi-Channel real time data posting

- Access up-to-date data on borrowers’ account, including posting status

- Post notes directly to member’s accounts and loans

- Provides borrowers instant assurance of payment posting

Learn more about Transaction Enablement™

-

9311 San Pedro Avenue, Suite 600

San Antonio, TX 78216 - 1-888-610-2574